Drive With Us

Owner-Operator

Hurdles & Solutions

Hurdles

- Drivers can’t afford to buy their own truck, especially with poor credit.

- Even with good credit, drivers need to pay a large down payment to buy their own truck. Many otherwise qualified drivers are blocked from becoming owner-operators.

- Drivers need to also gain their own motor carrier authority. This involves needing more capital to fund their insurance policy down payment. No company in the industry is assisting drivers to workaround this barrier so thousands of drivers are left hopeless.

Solutions

- We finance in house. All credit is welcome. Everyone is approved.

- We have companies that have grants up to $10K for down payment assistance.

- We have credit investors that will join venture with drivers who are ready for there own MC authority. We are the ONLY ones in trucking offering to connect credit investors.

The Process

Currently we have 40+ drivers that want their own home. We offer Credit Investors a “have their cake and eat it too” approach. Here are the steps. King of Flips LLC will wholesale the property to said Credit Investor.

King of Flips will then utilize wholesale fees to acquire a semi-truck for approved driver. The property being purchased is primarily for truck driver who has expressed interest in the subject property.

Within 90 days the credit of the driver will be 700 and they will have the income to acquire the property. We then introduce King of Flips to all investors. The avg Loan to Value will not exceed 90% LTV.

Take 10 minutes to get a $10,000 grant for down payment on a truck!

- Earn up to $3,000 a week!

- Build credit and repair credit while driving

- Local, Regional, or OTR

Ability To Predict The Future

Keys To Success

- First lien position secured on truck w/ 18% interest rate.

- Truck note will be sold within 90 days to note buyer.

- During process O.O. will escrow 5% per load to rebuilding credit.

- Owner-operator will meet with underwriting to understand what spend needs to be applied to rapid rescore their credit for an easy transition.

- This method is used in real estate for home owners seeking loan approval. We apply the same strategy to ensure note sale and/or Refinance.

- All owner-operator. Will rebuild credit and must maintain good credit or risk breaching contract and losing their truck.

- All loans will be FULLY insured @ $1M/$100K per FMCSA guidelines. Physical damage also must be in place for total loan amount of each truck sale.

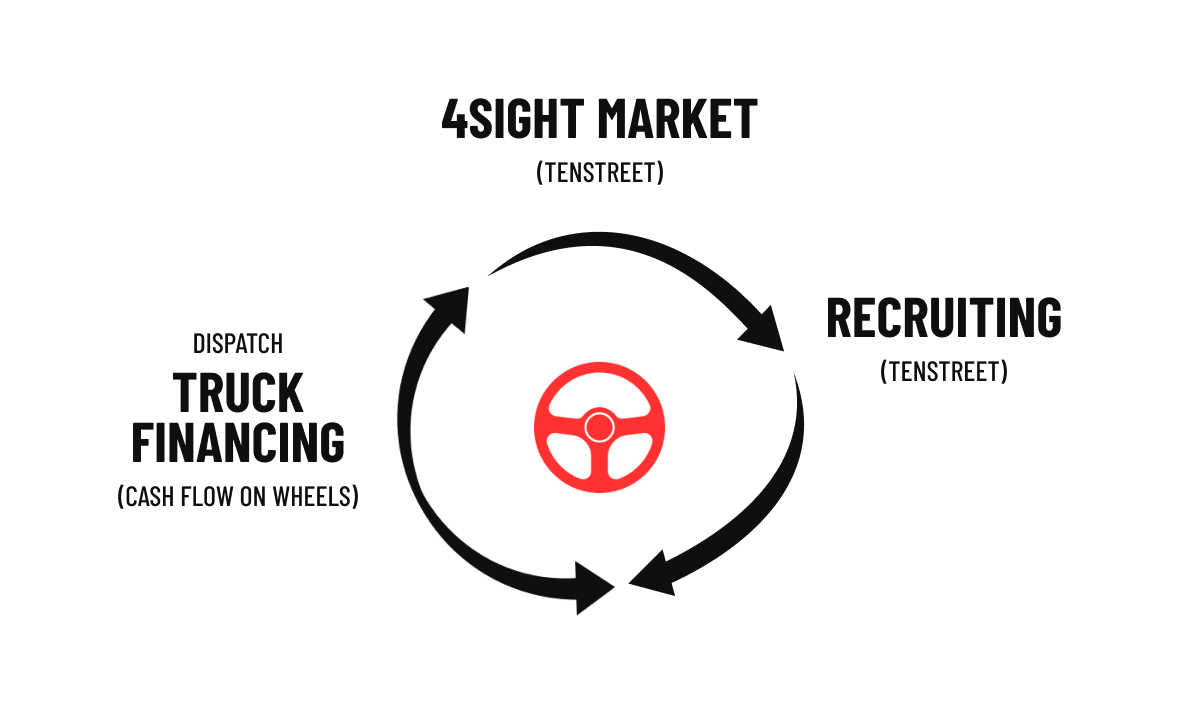

- Tenstreet is arguably the largest recruiting platform in the USA. Ony the majors use Tenstreeet to recruit drivers.

- We currently have over 3,000 drivers full applications through Tenstreet.

How Long To Get Your Truck?

Credit Score Opportunities & Benefits

500-599

Credit Score

90 days to keys

600-650

Credit Score

14 days to keys

650+

Credit Score

3 days to keys

Frequently Asked Questions

How Can You Get On The Waiting List?

You will not have extra days to wait unless something unforeseen occurs. Boss up and start truckin! All credit pulls are soft pulls. They will not affect your credit score.

How to get your truck fast, if you have bad credit?

You may be eligible to add a Credit Investor.

What does a Credit Investor do?

A Credit Investor will typically co-sign your truck purchase, in order to balance out your lower credit score on the application.

How does this help your application?

When Truck Financing companies see you have a cosigner, they will approve your application at a much faster rate.

Typical Credit Investors earn 12% of each load, until the truck is refinanced in your name.